Sébastien Martineau joined the Haulotte group 11 years ago. He has been Chief Financial Officer of this international and family-owned industrial group since January 2013, listed on the second market of the Paris Stock Exchange. Since January 2018, he has also been responsible for the IT Systems Department (ISD).

What is the Haulotte group's profile in terms of governance and capital structure today?

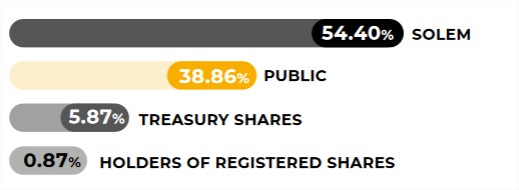

With 22 subsidiaries worldwide, 6 production sites and 2,000 employees, Haulotte is an international Medium-Size Industrial Company. Regarding its financial structure, it has been listed on the second market of the Paris Stock Exchange since 1998, but remains a family business, still 55% owned by its president and founder Pierre Saubot and his family: Alexandre Saubot is Deputy Chief Executive Officer. The floating capital represents 39% of the share capital, and the balance is treasury stock or held by employees. The Haulotte group therefore benefits from family governance. As such, our decisions are never subject to short-term financial objectives.

Breakdown of capital

Has this particular structure, unchanged since 1998, brought you particular benefits?

What is interesting about this family governance (55%) is that it makes it possible to apply a long-term strategy in a market marked by its cyclical nature. In addition, its listing on the secondary market (39%) requires the group to be more rigorous and transparent in terms of management and internal operations. This structure has a double virtue and has demonstrated all its advantages for more than 20 years

You mention the cyclical nature of the market, what are the other major trends that govern the sector?

The aerial work platform market is very cyclical, with cycles lasting on average 7 to 9 years. It owes its growth mainly to safety standards and the productivity gains that aerial work platforms make possible on working at height. The non-residential construction sector is one of these main markets. 80% of our customers are rental companies.

Like many sectors, this market experienced a very strong crisis in 2008, falling by 80%. Since then, it has steadily grown worldwide. This cyclicality requires us to be highly flexible and resilient, which is one of Haulotte’s major strengths, as confirmed by the 2008 crisis.

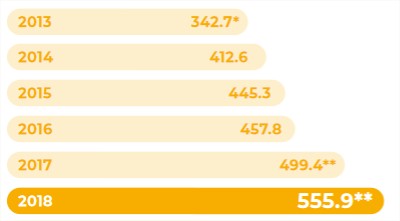

Sales evolution in € million

What are the main challenges that the group will have to face in the upcoming years?

There are many issues at stake. First, to support the Haulotte group’s growth (from €202 million in 2009 to €556 million in 2018) and its international development, in a constantly changing regulatory environment. Supporting development also means supporting innovation, which is central to our strategy. In addition, there are two other major challenges: the energy transition and the digital transition.

The overall objective is to successfully transform the group into an international brand, a reference in supplying global solutions with a strong service dimension; a "blue company", 100% electric, digital, innovative and environmentally friendly.

Sébastien Martineau Tweet

Regarding the digital transformation, what are the group's major projects at the moment?

2 types of challenges concern the Group’s digital transformation:

The internal challenges are to develop digital tools capable of improving the productivity and efficiency of our teams, and to develop collaborative work between the group’s 2,000 employees around the world. As such, the inauguration of our new international headquarters in spring 2020 will be emblematic of this digital transformation!

Then there are external challenges because our machines are increasingly connected and our rental customers are now waiting for offers in this direction, allowing them to geolocate their machines, to do corrective maintenance, preventive and tomorrow predictive in order to improve the cost of ownership of our equipment.